SogoTrade Review

- Customer Service

- Commission Fees

- Trading Platforms

- Research Tools

SogoTrade focuses on its offer rich in features and low-cost commissions when trying to attract active traders. Even though their offer is good, it simply can’t measure up to the competition’s.

Pros

- Commission rates for stocks and options are lower for active traders

- SogoOptions platform is good for both casual and advanced options traders

- Excellent and responsive telephone support

Cons

- Platform offerings are confusing

- Mobile trading is too basic for this day and age

- The research offering is rather poor

SogoTrade was founded in 1986. They are an online discount broker, and they aim to provide the cheapest possible commissions for their customers, while at the same time providing industry tools that are competitive.

In this review, we will see if SogoTrade is the best value broker out there or are their incredibly discounted trades too little for customer satisfaction.

Fees and Commissions

Their base charge for all equity trades is $4.88. Their clients who make more than 149 trades quarterly have their rates reduced to $2.88 per trade. SogoTrade also offers the option to prepay for trades. If you purchase at least 20 trades in advance, they will cost you $3.88 each, and last for a year.

Although they do offer many discounts, SogoTrade’s base charge of $4.88 is in like with big brands like Charles Schwab and Fidelity, who charge $4.95 for each trade. When it comes to option trades, they are more clear – $.50 for each contract, plus a flat $4.88. The commission structure SogoTrade offers is very similar to that of Firstrade (they charge $.50 per contract, plus $2.95).

SogoTrade charges $25 for mutual fund trades, which is really not a plus since their competitors charge less. But, that is not the biggest flaw of SogoTrade. What we really didn’t like is the fact that they don’t accept web orders. And that’s really inconvenient. Imagine – you have to execute each mutual fund trade via phone.

SogoTrade Tools and Platforms

SogoTrade has some good and some bad things here, so whether it’s good or bad depends a lot on your needs. The very first time we started using this broker, we were rather confused by the sheer multitude of platforms available. There are five of them, and we’ll explain each.

- SogoTrader – This is their basic platform for trading stocks. You can find watch lists, real-time quotes, order entry, and basic charting here.

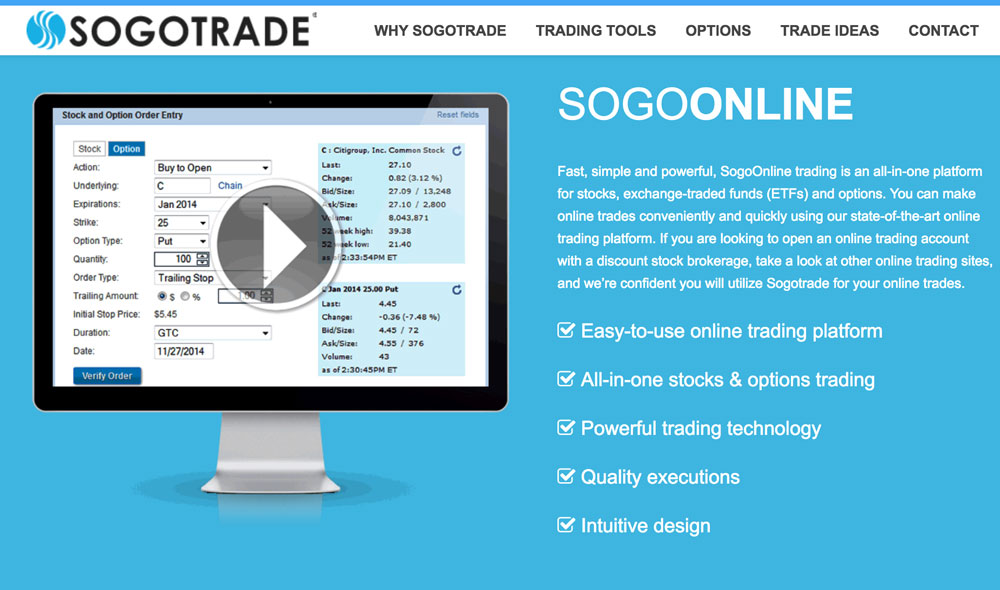

- SogoOnline – Order entry page that is available online. This is where you make basic options and stock trades, but also where you review the status of your orders.

- SogoOptions – Options traders will go here when using SogoTrade’s services. The platform is really well done and wonderfully functional.

- SogoElite – This is a desktop platform. It is made for active and advanced traders. It has a lot of handy features for stock trading.

- SogoPlay – SogoTrade’s newest addition. This is a licensed version of OptionsPlay. This platform basically uses fundamental and technical analysis to score and populate different trade ideas for options trading.

Although functional, all these platforms can easily confuse anyone, especially when you bear in mind that they all have similar names. As soon as you understand what is what, you’ll be able to choose a platform that is best for you.

A good thing here is the fact that you don’t have to pay extra for these platforms. They are all available to all of SogoTrade’s clients. The only exception here is SogoElite. In order to access it, you must have a portfolio with at least $100,000 balance.

Customer Service

We tested their phone customer service from many different locations in the U.S. and here’s what we got. SogoTrade’s call center average connection time is under one minute. Their average online chat service is not the fastest, but they are professional and helpful. If you need support, you won’t have a problem with this broker.

Research Offers

When it comes to fundamental research, SogoTrade offers very little. Yes, you can conduct some basic research on stocks and ETFs you’re interested in. But, research for pink sheet equities, fixed income, and mutual funds does not exist. This is where SogoTrade falls behind its competition.

Luckily, they also have one amazing tool that adds value to their research offering. SogoForecaster tool includes ETF and stock screening, ratings, and analysis.

Unfortunately, they also offer only one third-party research report provider, unlike their competitors, who offer up to 12.

Mobile Trading

Their app is available for both iOS and Android phones, it includes watch lists, real-time quotes, very basic charts and options chains. You can only make single-leg options and simple stock trades with it.

Final Thoughts on SogoTrade

While they do offer a lot of great discounts, and a list of pretty good tools, SogoTrade also has some serious flaws. While this might be enough for beginners, advanced traders will find this broker lacking.