Motif Investing Review

- Customer Service

- Commission Fees

- Trading Platforms

- Research Tools

Fast Company placed Motif Investing on a highly-coveted first place of their Most Innovative Companies In Personal Finance list. And, there are many reasons why they did that.

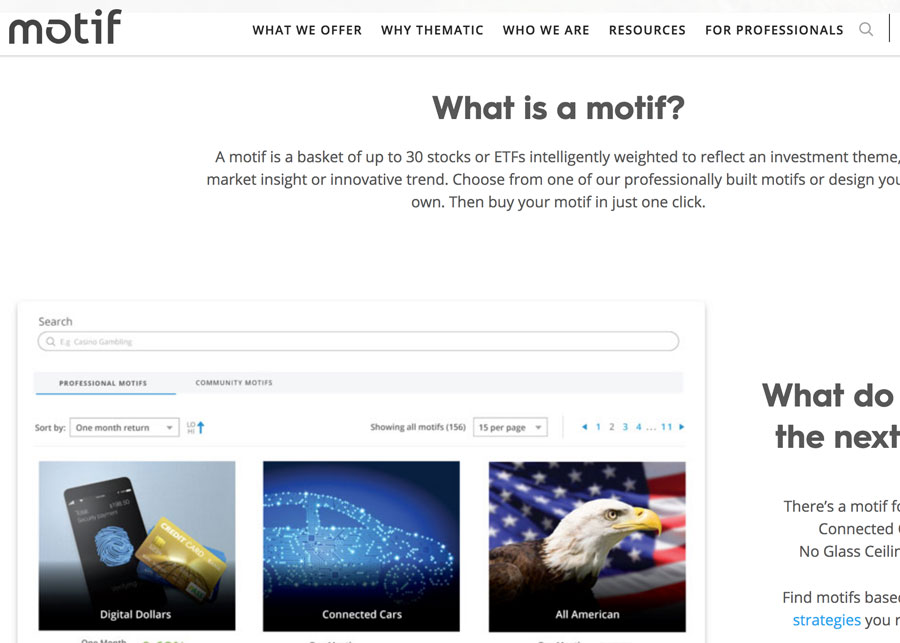

Motif Investing is a company that offers low flat fees to investors who choose one of their professionally created motifs. The choices are abundant – they have 150+ motifs available.

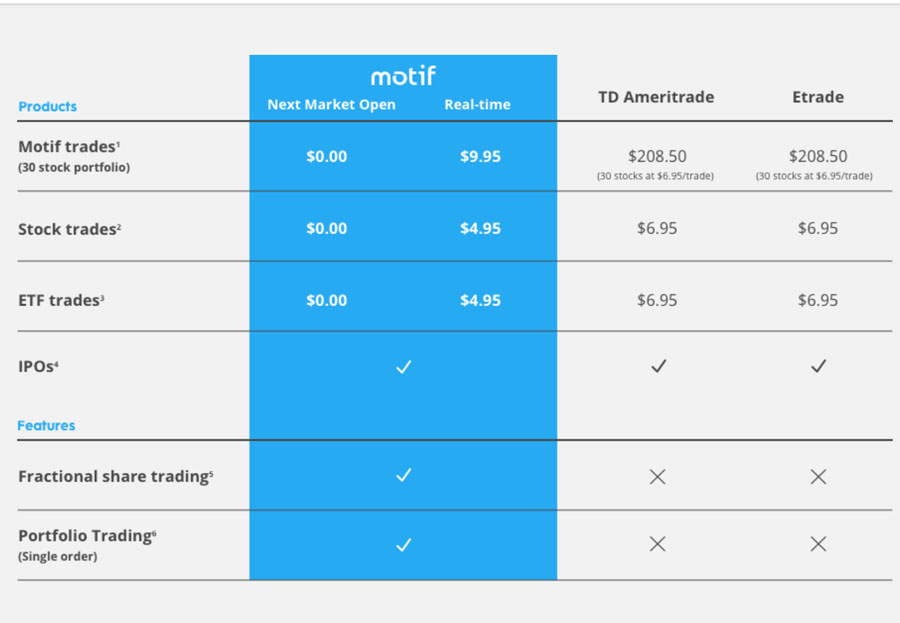

Trading Expenses

A motif is a stock or an ETF basket. It contains up to 30 trading assets from a particular sector, and if you want to sell or buy it, Motif Investing will allow you to do that for $9.95. Furthermore, if you’re going to make some changes inside the motif (buy or sell a single ETF or stock), it will cost you $4.95. That same rate is used for ETF and share purchases and sales outside motifs.

What’s fantastic about motifs is that you can customize them. Before you make a purchase, you can choose to modify the motif securities and change their weighting. In addition, you can also create your own motif.

Motif Investing also has a portfolio-rebalancing service. For $9.95, you can use this feature to keep your investment goals on track.

As far as inactivity fees go, Motif Investing doesn’t have them. The company also avoids charging maintenance fees, and they offer some no-fee IRA accounts for free as well.

If you want to see all their fees, you can visit their website.

But, there are some additional fees associated with full account transfers. If you want to transfer the account to another broker, but you don’t want to sell the securities, Motif Investing will charge you $65. Closing your IRA account will take $95 out of your pocket. However, if you just want a partial transfer in both of these cases, the fees are lower or non-existent.

You can open an account without a deposit, but your investment has to be at least $250. This minimum is also applied to other buy and sell orders as well unless you are placing a sell-all order on the motif.

Motif Investing Platform And Mobile Trading Services

Both the platform and the mobile app have a clean design and a user-friendly interface. There are iPhone, Android and iPad versions of the app, and the security precautions are high-quality.

Motif Investing Customer Support

Customer service is an area where Motif Investing excels. You can reach their representatives during business hours via phone or email. Furthermore, you can also contact their customer service support during the business week as well.

Motif Investing also allows its customers to connect with other users, friends, and family by using the Motif Investing social network. There, they can change the privacy settings and control what other members can see on their profile. They can also create an Investing Circle, which will serve as a community where they can talk to other investors and discuss news, experiences and trading insights. The trading community also provides them with resources about the latest trends, and they can even ask questions.

Motif Investing also has a reward system called Creator Royalty Program. By participating, investors can create new motifs and share them with other traders. If someone buys or rebalances one of their creations, they can earn $1 for each transaction. Investors can join the program free of charge.

Pros & Cons of Motif Investing

Pros:

- They offer inexpensive, flat-rate commissions to investors who wish to trade on their platform.

- There are no inactivity fees or hidden maintenance charges.

- IRA accounts come with no added fees.

- They have a variety of motifs available (150+).

- The company has a dollar-based royalty program and trading feature.

- There is a social network as well.

- The trades are executed in real-time.

- If you are an existing customer, you can participate in a referral program.

Cons:

- You cannot trade after the market closes.

- There are no DRIPs.

- If you want a broker to assist in your trades, you will have to pay expensive fees for it.

- You can only invest in ETFs, stocks, and ADRs.

Is it safe to use their services?

It is entirely safe to hire Motif Investing as your brokerage. The company is a FINRA and SIPC member, which means that they have insurance coverage through SIPC. However, if you go over the limit of that coverage, they also have an insurance policy by London Underwriters.

The main feature of this company is the low investment commission. Unlike Etrade, you can pay $9.95 per motif and trade up to 30 securities at once. However, if you want to trade individual stocks, it will cost you $4.95, which is an industry low maintained by Ally Invest and Optionshouse.

You also don’t need a minimum amount of funds to open an account with them. Furthermore, the fees are stated on their website, which means that this discount broker values transparency.

Motif Investing is the right choice for investors who want to avoid expensive fees. In addition, this company is also a great place to get investment advice. And, if you are a mobile user, you can use the app and manage your portfolio through it.