Ally Invest Broker and Platform Review

- Customer Service

- Commission Fees

- Trading Platforms

- Research Tools

For over a decade, TradeKing operated as an independent online broker. Two years ago, the platform was acquired by Ally Financial for more 257 million dollars. Now, the platform functions as a discount brokerage arm of Ally Financial.

These days, Ally Bank customers will find themselves right at home as their investment/banking accounts can be managed through one single login. While this is a major plus, the Ally Invest experience certainly isn’t perfect. There are a few Ally Invest reviews that highlight some of the issues.

This brings us to our main topic – is opening an Ally Investment account really worth it if you’re not an Ally Bank customer? Well, let’s dive into the subject and find out whether it’s worth it or not.

Ally Invest Fees and Commissions

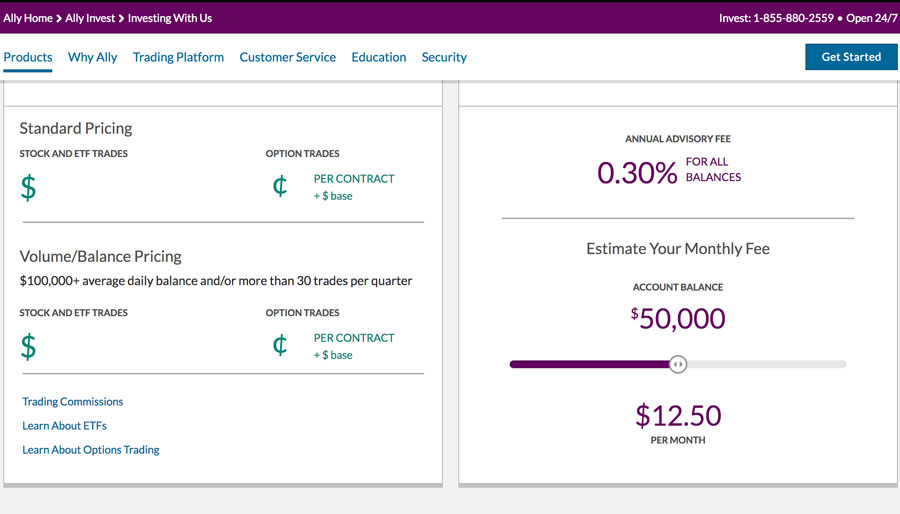

The fee for regular stock trades is 4.95 dollars. Options trades also cost 4.95, but you have to pay a 65-cent per contract fee as well. If you manage to maintain a 100K balance, the rate will be reduced to 3.95 per stocks and 3.95 plus a 50-cent per-contract fee for options.

In 2016, these rates were pretty valuable, since Ally Invest outperformed its competitors with a great offering of tools, education, and research. However, last year, Charles Schwab started a price war, which forced the largest brokers in the country to cut their commission rates.

And once the dust finally settled, Charles Schwab and Fidelity Investments had the same regular and options as Ally Invest. Even though Ally Invest still has the lowest cost of trading mutual funds, in terms of per-trade rates, the platform is no longer the value leader.

Interface and Ease-of-Use

Now, ease-of-use is a category that encompasses a large area – from simply logging in and managing preferences to conducting research and placing trades.

For starters, managing your account is not so hard – both transferring assets and year-end reporting is seamless, especially if you’re an Ally Bank customer. Furthermore, if you’re just an Ally Invest customer, you automatically default to the Ally Invest LIVE website. You can place a trade on basically any page with the use of the QuickTrade tool.

And while users will feel at home with the LIVE website, we should note that not all functionality from the old site has migrated over. For example, the research area is not as good as it once was and in order to access it, you have to contact the site’s personnel.

Lastly, if you want to trade forex or futures, you need to open a separate brokerage account. However, since futures and forex trading isn’t so common in the United States, this isn’t really such a big deal.

Ally Invest Platforms, Features, and Tools

Ally Invest Live will provide a great experience for both desktop and mobile users. When you log in, you’re greeted by the Home Screen that has W10-like titles. It provides a quick view of everything you need to manage your portfolio.

The charting capabilities are fantastic – modifying settings and performing chart analysis is a great experience. You also have 10 different tools, as well as more than 80 technical indicators. The P&L charts are customizable, easy-to-understand, and flow pretty well with the rest of research options.

However, when compared to other platforms in the same price range, Ally Invest, unfortunately, falls behind the industry leaders. The platform will probably satisfy casual investors, however, active traders should look elsewhere. There are several areas that need improvement.

The viewing experience should be Ally Invest’s top priority – while the desktop version is clean, the mobile version still needs some tweaks. What’s more, the website’s research features has still not made its debut. Of course, active traders aren’t really Ally’s target demographic, but still, we felt that these faults needed to be mentioned.

Ally Mobile App

The mobile app was updated last year to include brokerage and Ally Bank capabilities. If you’re an Ally Bank customer, jumping between brokerage and bank areas is quick and smooth. If you’re an iPhone user, you can now log in through the Touch ID.

When it comes to functionality, the app provides a bug-free experience that includes the core features you need to manage your portfolio efficiently. It allows you to view your watch lists, check your holdings, and analyze charts in real time.

The Bottom Line

If you’re an Ally Bank customer, there certainly are many benefits of using Ally Invest. As we noted, the universal dashboard allows you to seamlessly manage all of the accounts under one roof. Plus, the platform provides a nice set of investment and research tools, although not all of them are available on the LIVE platform.

On the other hand, if you’re not a regular customer, you should probably find another discount broker. Simply put, Ally Invest doesn’t provide the value it did just a few years ago. For the same money, you can actually find a number of superior brokers out there.