Vanguard Brokerage Review

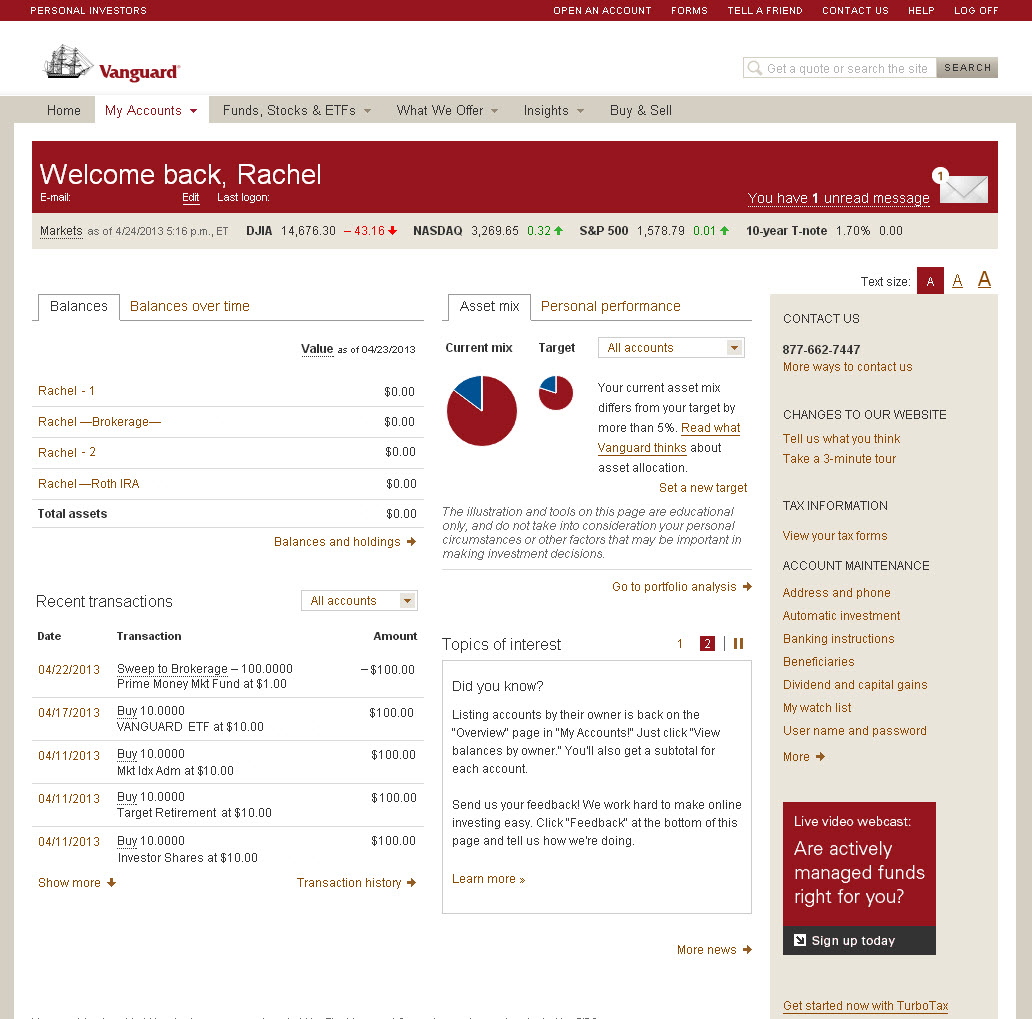

- Customer Service

- Commission Fees

- Trading Platforms

- Research Tools

Vanguard is a brokerage that is offering many options in regards to IRA management.

They are offering low cost, fee-free investments in most IRA mutual funds or brokerage accounts. They have a low expense ratio of 0.19%, in comparison to the industry average of 1.08%. However, some of the funds have high fees because Vanguard wants to prevent short-term investments. In addition, the steep fees allow them to control expenses.

Vanguard Expenses

If you are an active trader, you will have to pay significant fees to Vanguard. Not making substantial investments means that the costs will be higher if you are trading options and stocks.

Each year, you can get the first 25 trades for $7 per trade, and that’s only if you are an investor with under $50,000 worth of holdings. Anything above that trade limit will raise the fee to $20. Hence, if you are looking for a brokerage that will allow you to choose and hold companies for a long time, Vanguard might be the right choice for you.

Nevertheless, if you are an active trader, Vanguard commissions might eat up all your gains. Most active traders make more than 25 trades in just one month, which means that you will have to pay a huge commission for trades above that limit.

In addition, Vanguard offers commission-free ETFs as well – 67 of them, to be exact. That is a considerable advantage over their competition.

All of their mutual funds are commission-free, and Vanguard is also offering a tired commission fee for other mutual funds. But, you need to have at least $50,000 to qualify. In contrast to Scottrade, Vanguard’s costs are higher. The broker charges $35 on standard accounts, and the lowest fee is $20. Meanwhile, Scottrade requires a $17 mutual funds fee, regardless of the account value.

As far as the yearly fee goes, Vanguard is charging investors $20 if they have less than $10,000 in holdings.

Competitors Comparison

The Vanguard brokerage has member levels combined into a graduated system. They are Voyager Select, Voyager, and Flagship Services. But, the trade costs and fees are different on each level, and they depend on the value increase of your investment holdings.

Vanguard also offers its members a discounted analysis, provided by a Certified Financial Planner. Thus, the investors can create an investment strategy according to their goals and preferences.

Vanguard Customer Support

When it comes to customer service, Vanguard has a few short-comings. They do not offer in-person appointments like their competitors, Etrade and Scottrade. Furthermore, they don’t have live investing workshops or in-person guidance meetings.

Nevertheless, to compensate for these slips, Vanguard offers phone consultations and video conferences. Thus, investors can directly contact an advisor and get reassurance and guidance from him.

Trading Tools

If you want to control your IRA account personally, Vanguard has your back. Their platform has many online guides and calculators, and you can also use their research tools. In addition, they also offer their users articles about investment and market strategies.

Vanguard’s mutual fund calculators are useful tools you can use to predict risk. They have various sliders and button inputs which allow you to select your exact financial situation and goals. Afterward, the calculators give their recommendations. They also show what options you have, as well as risks and possible gains.

Vanguard also has calculators that allow you to determine costs and make a distribution plan. All you have to do is input your age and your expected needs. The calculator will then offer you a guide, and it will also explain to you how your IRA account can affect your financial stability and your holdings. Just like other calculators, this one also has user-friendly sliders you can use to tweak your answers. The sliders also influence the creation of your investment profile, which will help you make better investment decisions in the future.

Vanguard Pros & Cons

Pros:

- They offer low-cost mutual funds.

- 67 of the Vanguard ETFs are commission-free.

- You can have phone consultations and video conferences with an adviser.

Cons:

- After you make the first 25 trades, Vanguard will implement expensive stock and ETFs trading commissions.

- The base options for trading commissions are also quite high.

- Fund investment minimums are high (up to $10,000).

- They don’t offer in-person appointments, advice or guidance.

- If you are an active trader, you will have to pay incredibly high fees.

- Their customer service is not up to standard.

- Opening your account takes a while.

- Average quality trading tools.

- There is an annual IRA account fee.

Final Thoughts

If you are a high net worth investor, Vanguard might be the right choice for you. You can benefit from their low-cost mutual fund offerings. But, if you are more of an active trader, there are better brokerages on the market.

ive been using vanguard for 5 years and I have nothing but good things to say about them

you really can’t beat vanguard’s mutual funds. highly recommended for all investors